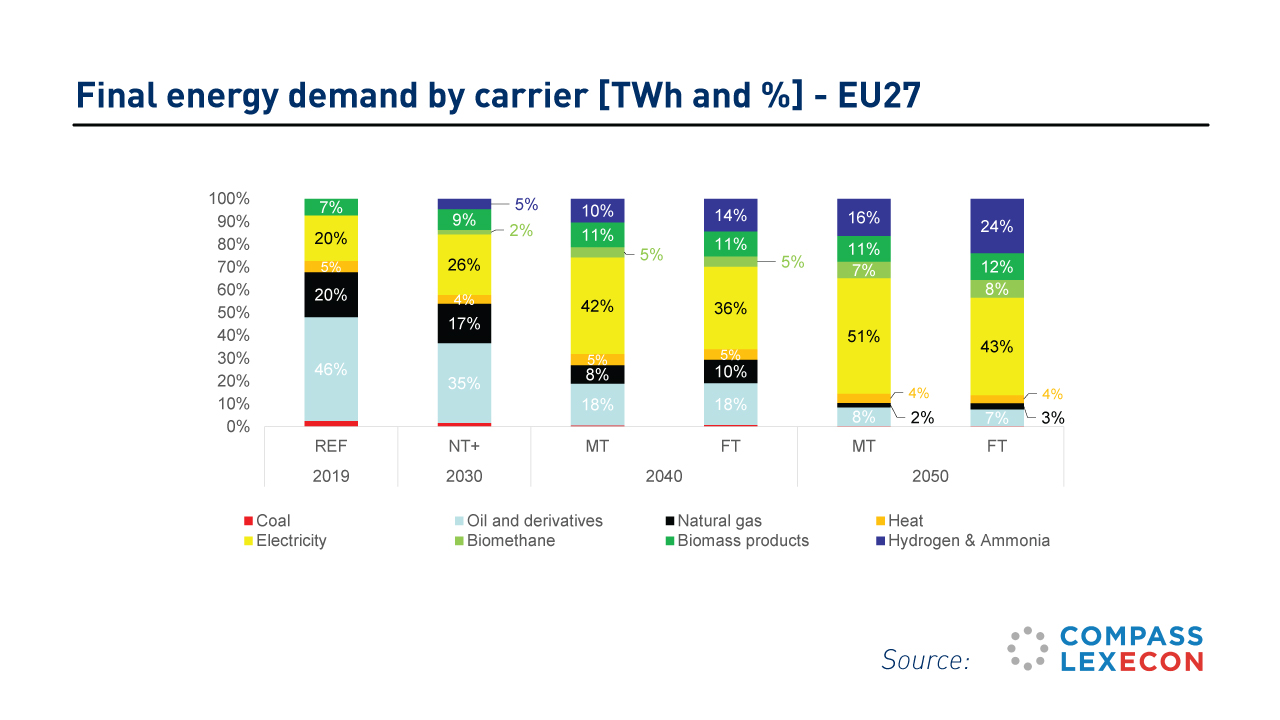

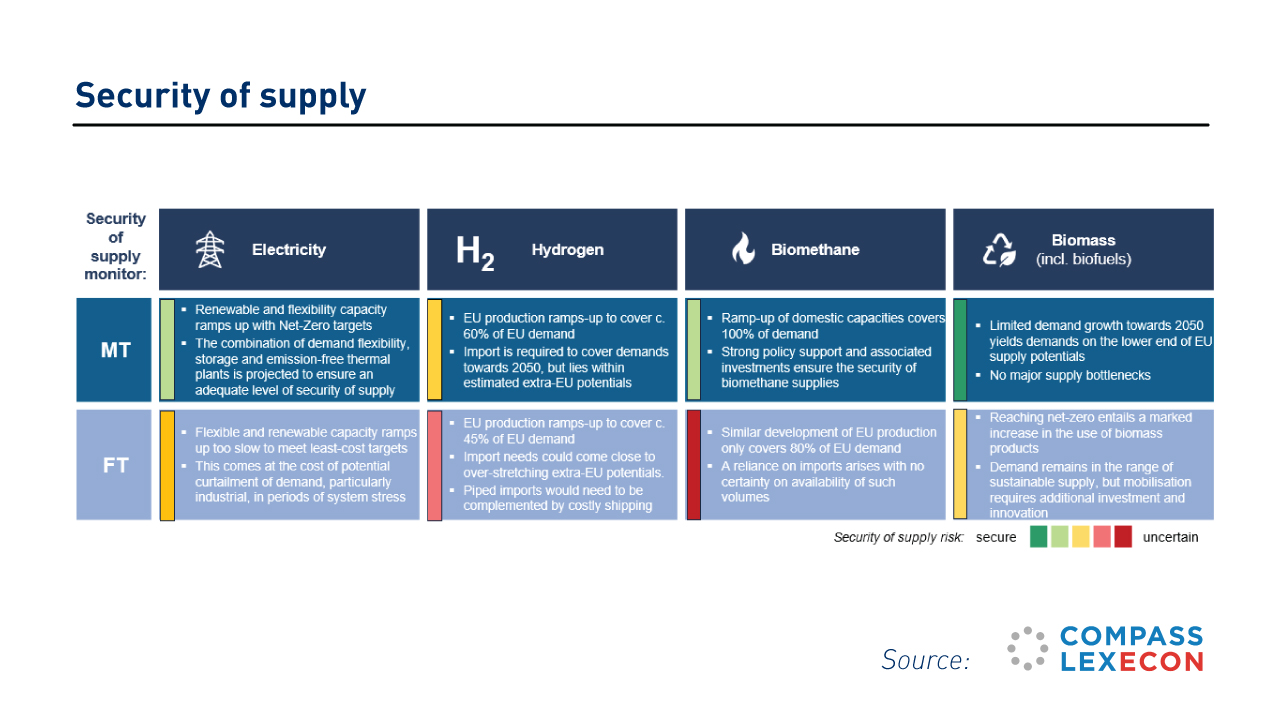

According to the report’s findings, reaching climate neutrality by 2050 requires a deep electrification of our economy. At the same time, the 2050 energy mix will rely on a combination of different energy carriers such as wind and solar, hydrogen, biomethane and biomass products, and nuclear. European energy policy must therefore focus on ensuring a sufficient supply of all generation sources and infrastructure. In this context, guaranteeing technology neutrality at EU level is key, where we recognise the need for diverse and complementary means of reaching Net-Zero.

More broadly, EU energy policy needs to move towards a fully comprehensive and coherent policy framework. This should cover all the key elements which are needed to make the energy system more cost-effective, modern and robust, including: the supply of renewable and low-carbon energy, energy storage, efficiency measures and demand-side management, energy infrastructure, carbon capture and storage, flexible capacity, and interconnections.

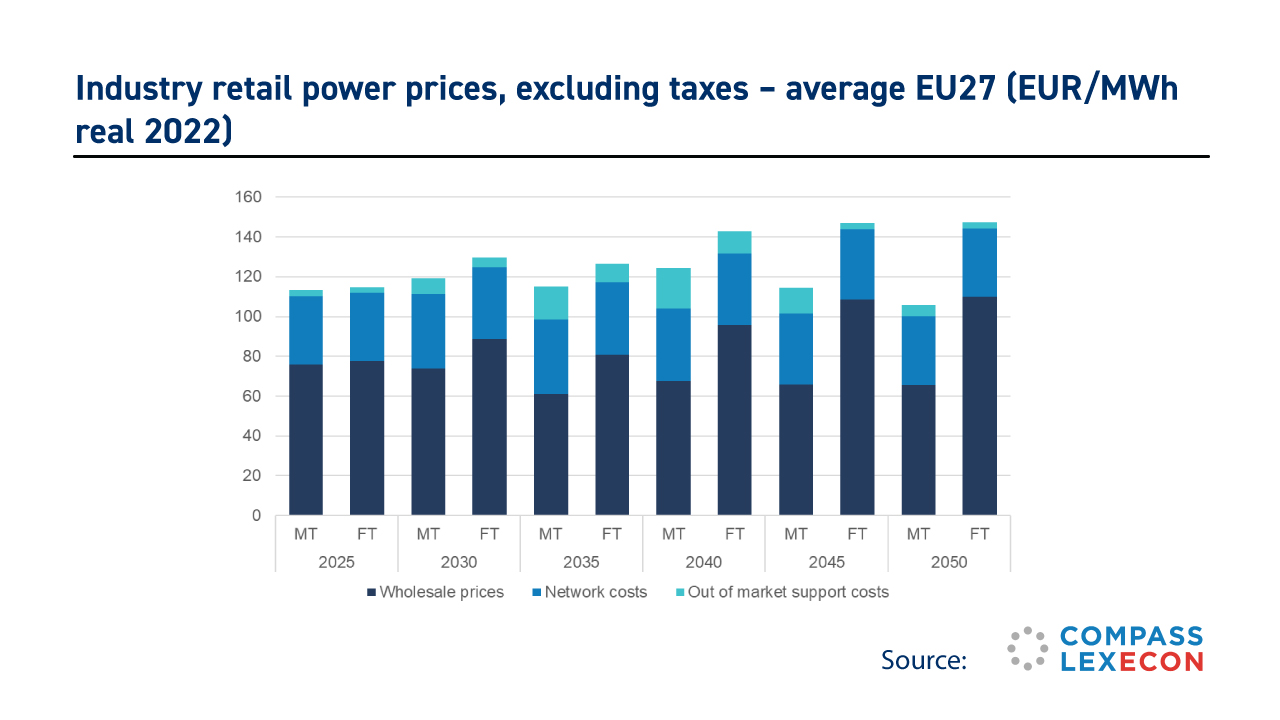

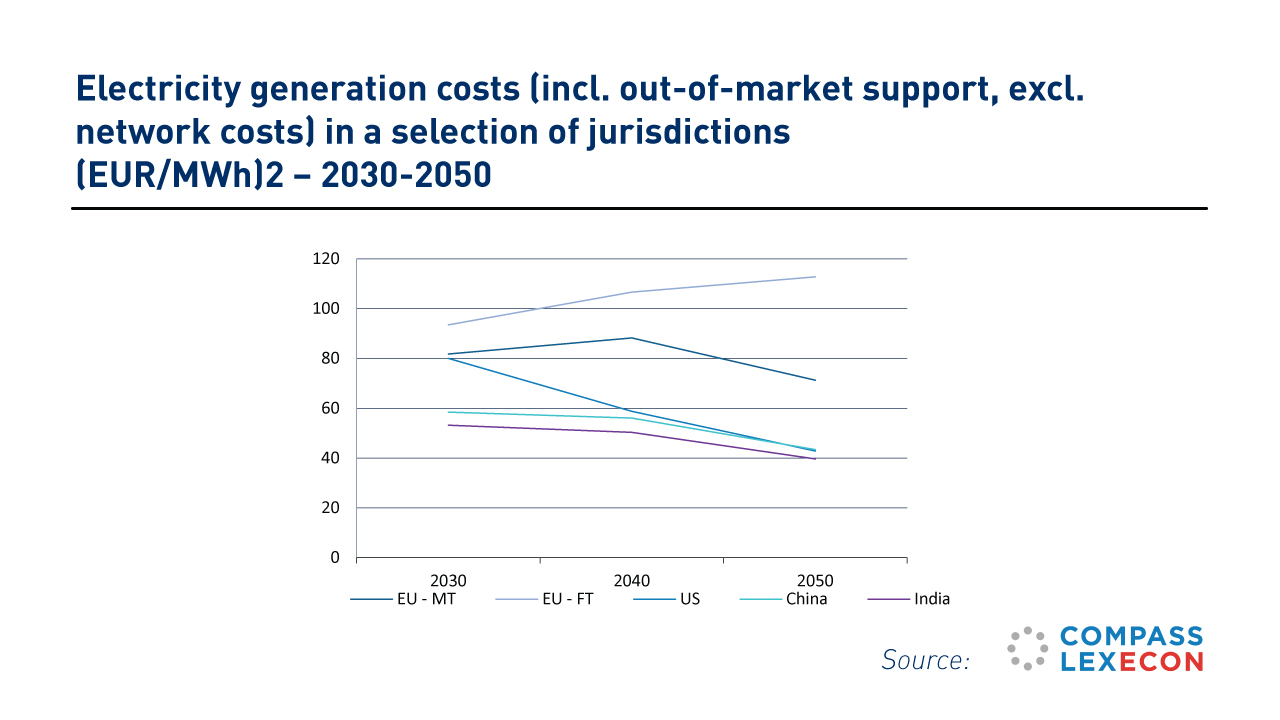

Supporting the development of renewables and low-carbon resources along with the necessary infrastructure will not only enhance the security of Europe’s energy system but should also help reduce the overall cost of the energy and climate transition. The report finds that when renewables are developed in the least-costly locations and the roadblocks to their development are lifted, including on interconnections, this could lower wholesale power prices by almost 40%.

A well-integrated energy market will play a key role in incentivising investments in the energy system, ensuring a stronger convergence of energy prices within the EU and guaranteeing long-term security of supply and lower prices for consumers.

Further action is needed to implement the Electricity Market Design agreement and scrutinise any existing barriers to signing long-term agreements, such as corporate Power Purchase Agreements and Contracts for Difference.

These contracts contribute to the establishment of long-term price signals and ensure visibility and stability for both electricity consumers and producers. They are also important in encouraging new investments in renewable and low-carbon power generation of all types, as well as investments in demand flexibility tools.

Likewise, the Commission should carefully monitor the implementation of the 2023 Hydrogen and Decarbonised Gas Market Package, to ensure the timely and efficient development of markets for renewable gases and hydrogen. It is key to drive investment in production and transport of those energy carriers. In this context, it is crucial to complete the internal European gas market to strengthen the EU’s security of supply[1].

[1]For this, existing regulatory, operational, and commercial barriers need to be removed. In places where the entry-exit zones are relatively small and the transits cross several borders, gas flows are being charged exit and entry fees each time, leading to a pancaking effect for users. See BusinessEurope reply to the ‘gas networks’ consultation.